Elliott Wave Theory is a form of technical analysis that explains market price movements as repeating wave patterns driven by investor psychology—the natural cycle of optimism and pessimism in financial markets.

It was developed in the 1930s by Ralph Nelson Elliott.

Core Idea

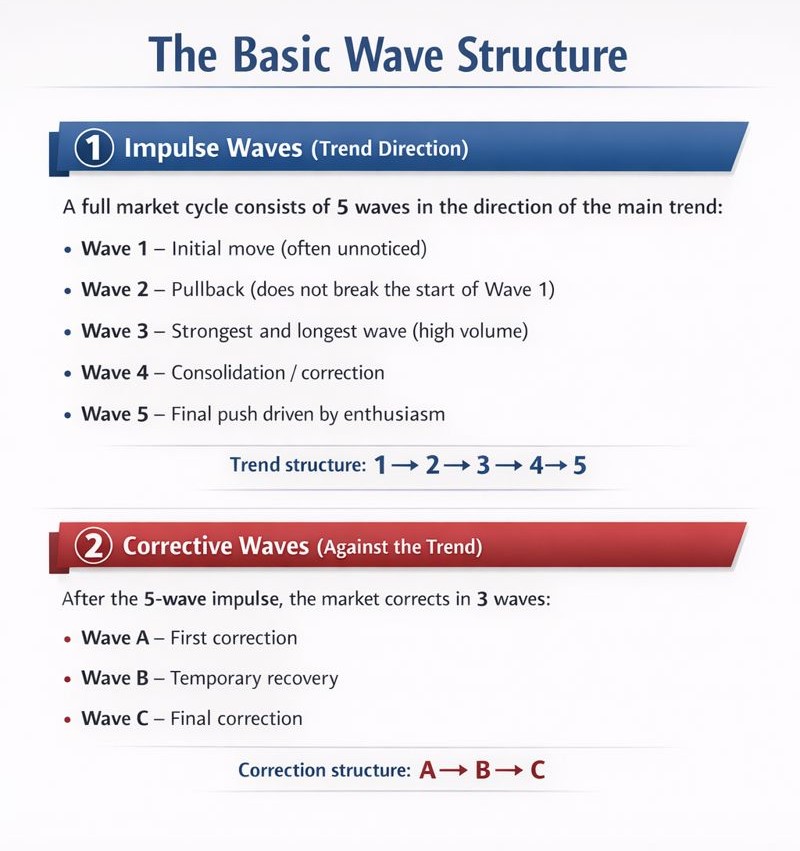

Markets move in predictable cycles. These cycles appear as waves that repeat across different timeframes (minutes, hours, days, years).

Key Rules of Elliott Wave

These rules must never be violated:

- Wave 2 cannot retrace more than 100% of Wave 1

- Wave 3 is never the shortest among Waves 1, 3, and 5

- Wave 4 cannot overlap the price territory of Wave 1 (in most markets)

Fractals & Timeframes

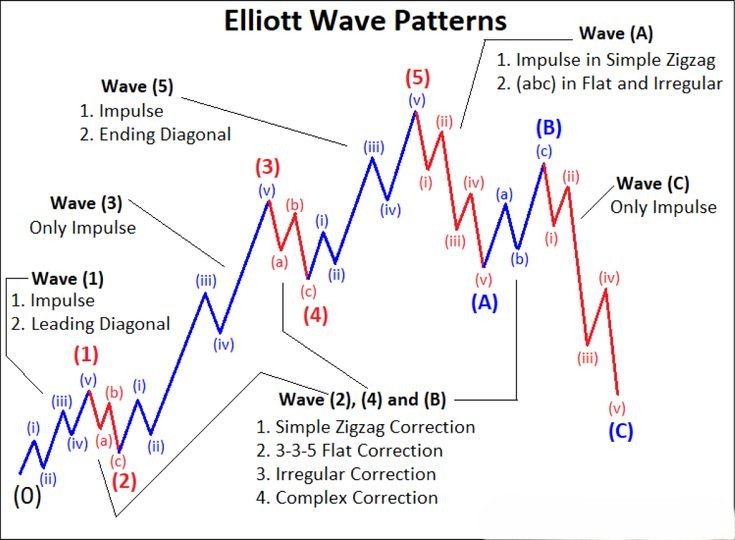

Elliott Waves are fractal:

- A wave on a daily chart contains smaller waves on an hourly chart

- The same structure appears on any timeframe

Common Tools Used with Elliott Wave

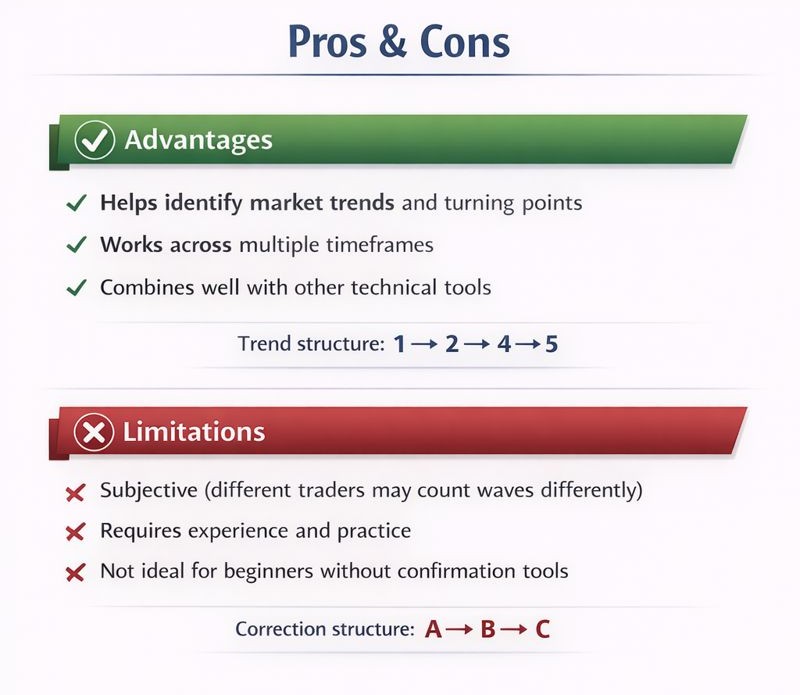

- Fibonacci retracements & extensions

- Trendlines

- Momentum indicators (RSI, MACD)

- Volume analysis

Where Elliott Wave Theory Is Used

It is commonly applied in:

- 📈 Stock markets

- 💱 Forex

- 🪙 Crypto

- 🛢️ Commodities

- 📉 Futures & CFDs

Especially popular for swing trading and trend forecasting.

In Simple Terms

Elliott Wave Theory says that markets move in waves because people think and act in patterns.