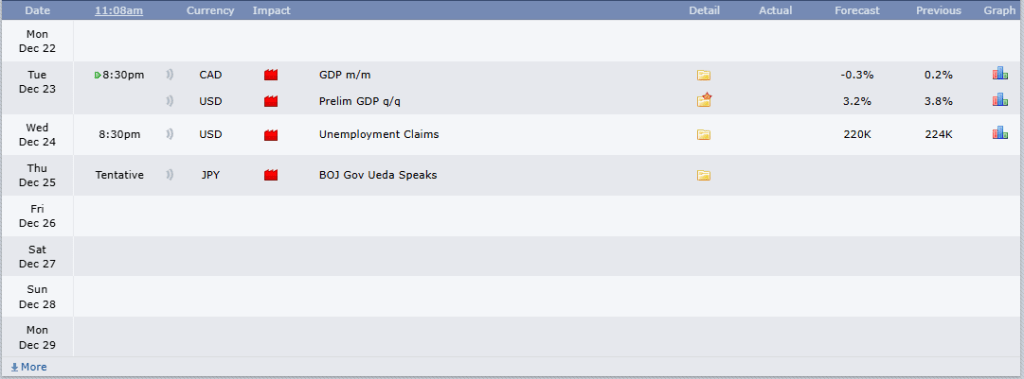

This appears to be a relatively quiet holiday week, though several key data releases could still shape market sentiment. The highlights include Q3 GDP figures and December’s Consumer Confidence Index.

The economic uncertainty stemming from the government shutdown continues to spill over into the new year. While recent employment data suggest the labor market may be more resilient than previously thought, concerns remain over data quality. Similar reliability issues apply to other recently released economic indicators.

Last week’s November CPI added to the uncertainty. Although the softer-than-expected 2.7% y/y reading was welcome, it also reignited doubts about the accuracy of post-shutdown data.

Meanwhile, investors remain cautious about the sustainability of the year-end stock rally during this shortened Christmas week. Any signs of holiday optimism could support Wall Street, as markets closely assess heavy corporate investment in AI and evolving expectations around whether—and when—the Fed, under Powell’s leadership, may consider easing policy again in early 2026.

Below are several upcoming data releases that could influence the Fed’s assessment of how the US economy is navigating the exit from an unusually turbulent year.

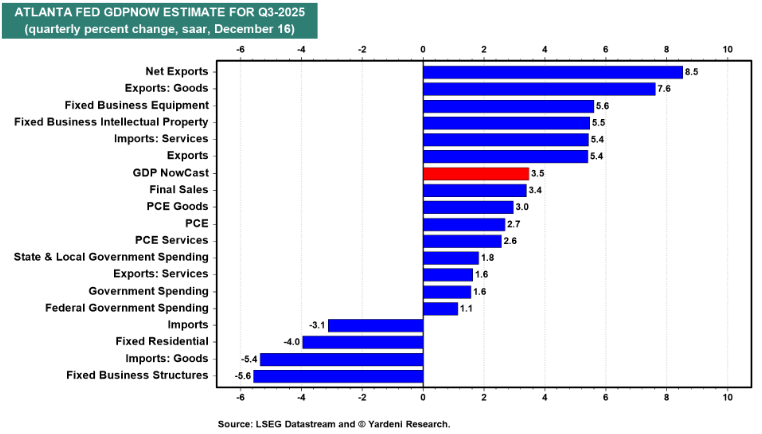

GDP Update

Real GDP expanded at a 3.8% annualized pace in Q2. We expect Q3 GDP growth to remain solid at around 3.5% (annualized), reinforcing the view that economic momentum remains resilient. Such an outcome would align closely with the Atlanta Fed’s GDPNow estimate (see chart).

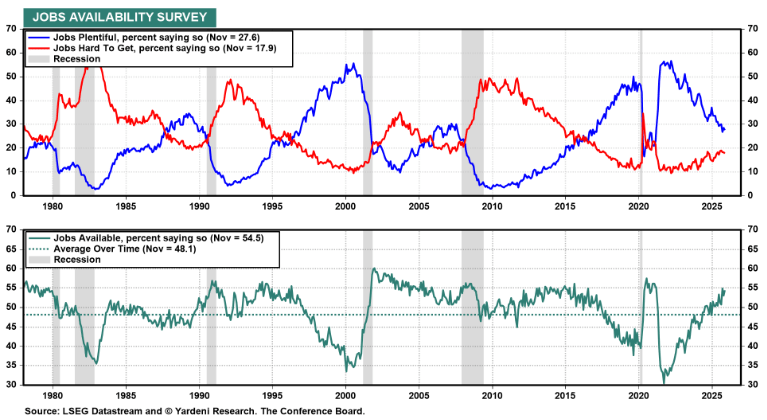

Consumer Confidence

With government data still arriving slowly and often sending mixed signals, private surveys are playing an unusually prominent role. The Conference Board’s Consumer Confidence Index (Tue) is a key example, offering one of the earliest monthly signals on labor market conditions. We expect the survey to indicate that job market dynamics remain mixed (see chart).

Jobless Claims

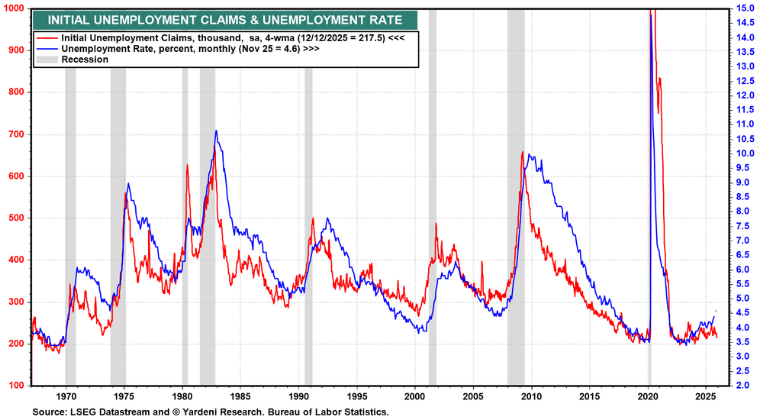

Amid ongoing data uncertainty, weekly initial unemployment claims (Wed) remain a key reference point for investors seeking clarity. Following last week’s 224,000 reading, claims are expected to once again signal subdued layoff activity. This would support the view that the unemployment rate could edge slightly lower in December after rising to 4.6% in November (see chart).

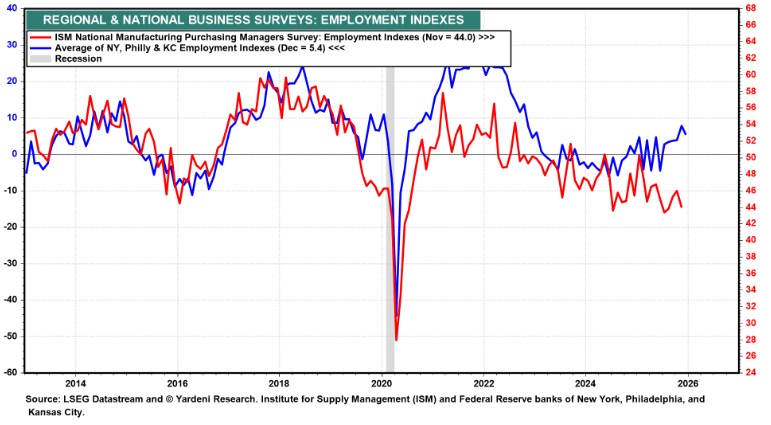

Regional Fed Surveys

The week begins with the Chicago Fed’s National Activity Index for November (Mon), followed by the Richmond Fed’s December business survey (Tue). While regional Fed surveys have faced data-quality challenges amid the broader slowdown in government releases, the Richmond report may help confirm the solid December employment readings seen in surveys from the New York, Philadelphia, and Kansas City Feds (see chart).