Dow Theory is a foundational theory of technical analysis that explains how financial markets move and how to identify the primary trend of the market. It was developed from the writings of Charles H. Dow, co-founder of The Wall Street Journal and creator of the Dow Jones Averages.

Core Principles of Dow Theory

1. The Market Discounts Everything

All available information—economic data, news, earnings, and investor psychology—is already reflected in market prices.

2. The Market Has Three Types of Trends

- Primary Trend: Long-term direction (months to years)

- Secondary Trend: Medium-term corrections within the primary trend

- Minor Trend: Short-term fluctuations (days to weeks)

3. Primary Trends Have Three Phases

- Accumulation Phase: Smart money begins buying quietly

- Public Participation Phase: Trend becomes obvious; volume increases

- Distribution Phase: Smart money exits; late investors enter

4. Indices Must Confirm Each Other

A trend is confirmed only when related indices move in the same direction

(e.g., historically: Dow Industrials & Dow Transportation).

5. Volume Confirms the Trend

- Volume should increase in the direction of the primary trend

- Weak volume = weak trend confirmation

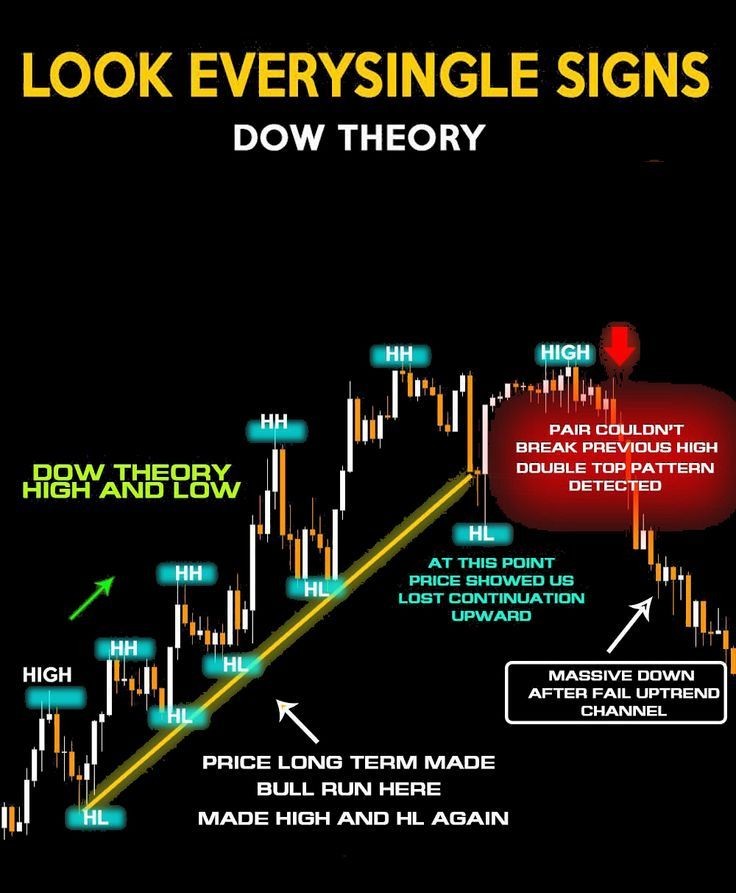

6. Trends Persist Until Clear Reversal Signals

A trend remains in effect until strong evidence shows it has reversed.

Why Dow Theory Matters

- Forms the foundation of modern technical analysis

- Helps traders identify market trends and trend reversals

- Works well with tools like trendlines, moving averages, Elliott Wave Theory