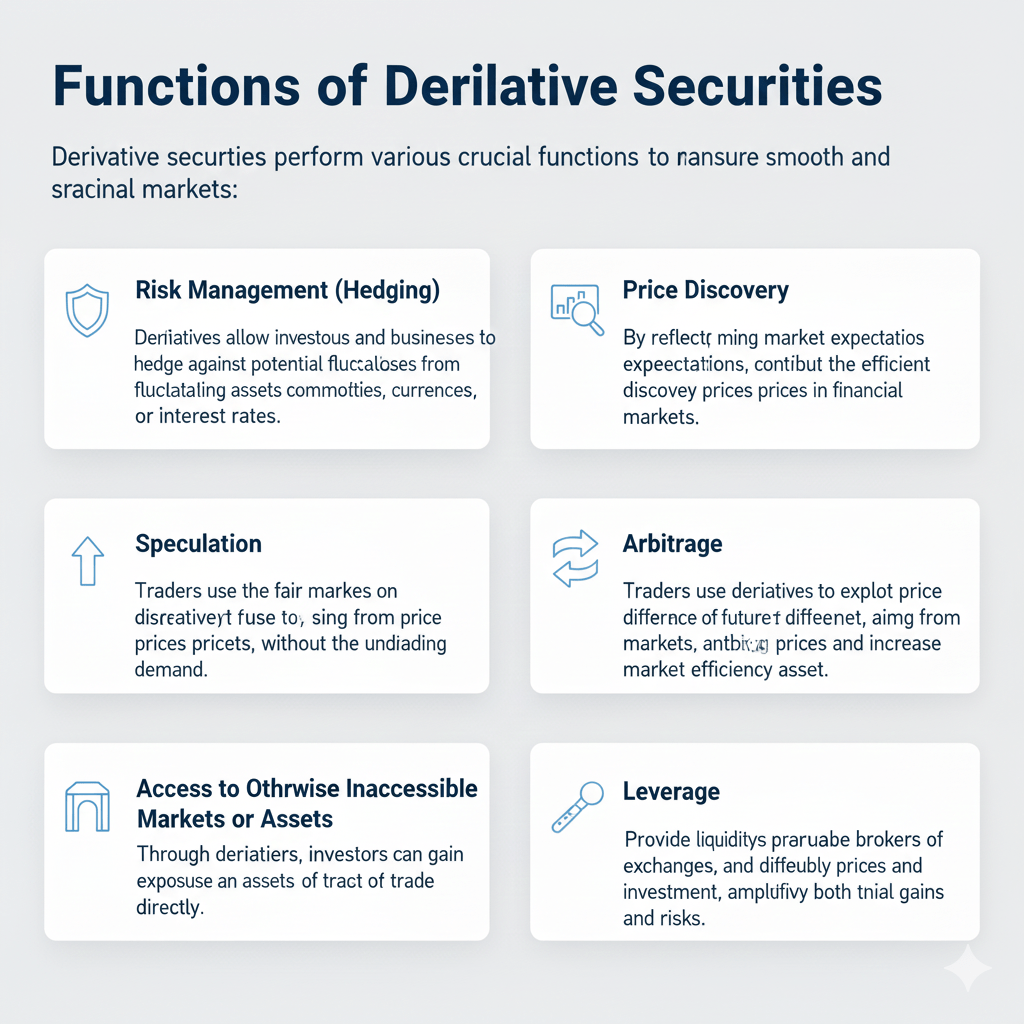

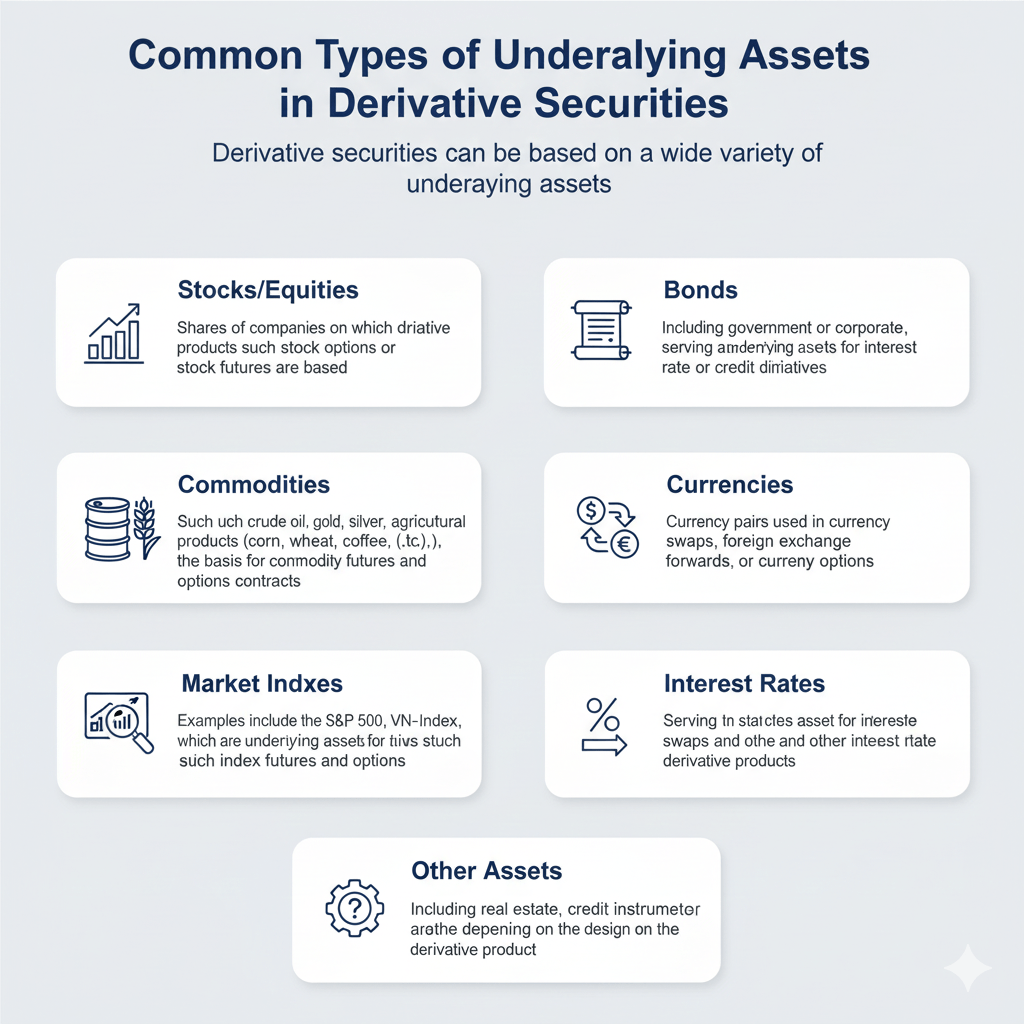

Derivative securities are financial instruments whose value is derived from the value of an underlying asset, index, or rate. Common underlying assets include stocks, bonds, commodities, currencies, interest rates, or market indexes. Derivatives are primarily used for hedging risk, speculation, or arbitrage.

Main Types of Derivative Securities

- Futures Contracts

Standardized agreements traded on exchanges, obligating the parties to buy or sell an asset at a predetermined price on a specified future date. - Options

Contracts granting the holder the right, but not the obligation, to purchase (call option) or sell (put option) an asset at a specified price within a defined time period. - Swaps

Customized, over-the-counter agreements between parties to exchange cash flows or financial instruments, commonly used to manage interest rate or currency risks. - Forwards

Private, non-standardized contracts between two parties to buy or sell an asset at an agreed price on a future date, typically traded over-the-counter.

Markets for Trading Derivative Securities

- Exchange-Traded Market (ETM):

This is where standardized derivative contracts are traded on formal exchanges such as the Chicago Mercantile Exchange (CME), NYSE, or Vietnam’s Commodity Exchange (MXV). - Over-The-Counter (OTC) Market

This market involves direct trading between parties without going through formal exchanges. Contracts are often customized according to the agreements between the parties.