Market Overview

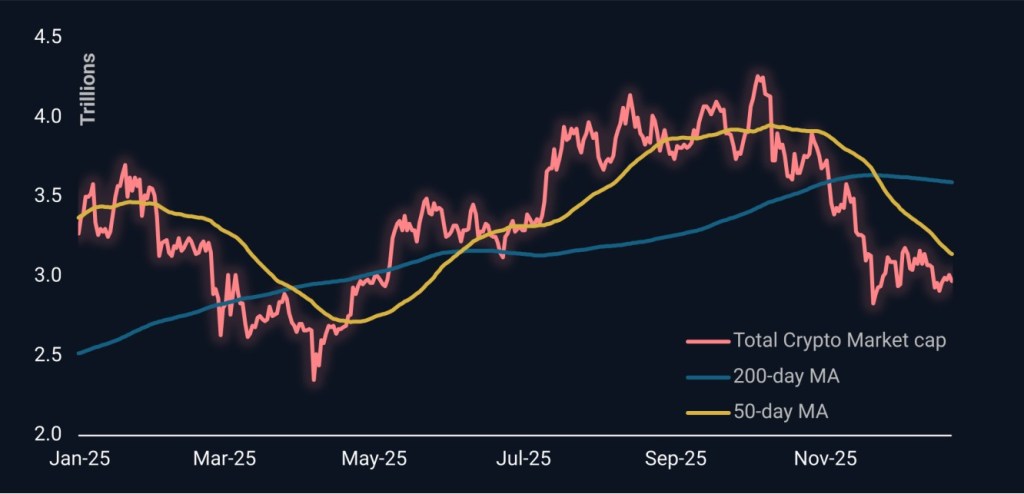

The crypto market capitalization fell 1.4% to $2.97 trillion, slipping below the $3 trillion threshold once again. The market failed to sustain the robust rebounds seen after local lows on November 23 and December 2, signaling increasing selling pressure.

The longer prices remain distant from recent highs, the more large players appear to be betting on a shift toward a bear market. Unlike retail investors, who often generate sharp price moves, large players tend to execute prolonged and measured sell-offs, with little indication they will quickly return to buying.

Bitcoin was once again sold off after briefly rising above $90,000. Notably, this sell-off occurred amid a decisive rally in gold and other precious metals, alongside a weakening U.S. dollar.

This dynamic underscores a shifting risk sentiment, further confirmed by the sell-off in global bonds. In the coming weeks, we can expect a more pronounced decline in cryptocurrencies, accompanied by a broader spread of risk aversion impacting stocks and currencies in emerging markets.

News Background

According to CoinShares, global investment in crypto funds declined by $952 million last week, following three consecutive weeks of inflows. Bitcoin saw outflows of $460 million, Ethereum $555 million, and multi-asset funds $56 million.

Meanwhile, investments increased in Solana by $49 million, XRP by $63 million, and Chainlink by $3 million.

2026 Outlook: Turbulence Ahead for Bitcoin

Galaxy Digital warns that 2026 will be a turbulent year for Bitcoin, with economic and political risks, combined with a lack of clear market trends, creating a challenging environment for the flagship cryptocurrency. BTC is expected to remain in a chaotic phase with a high risk of correction.

Billionaire investor Ray Dalio expressed skepticism about Bitcoin’s future as a store of value and means of payment. He noted that Bitcoin can create unnecessary problems for its owners and is inferior to gold in preserving value. Dalio also believes BTC is unlikely to be held in significant volumes by central banks or large-state reserves for fundamental reasons.

In notable buying activity, BitMine acquired 98,852 ETH (~$300 million) last week at an average price of $2,991. The company’s Ethereum holdings have now reached 4.066 million coins, representing 3.37% of the total supply of the second-largest cryptocurrency by market capitalization. BitMine CEO Tom Lee called reaching 4 million ETH in just five months “an incredible achievement.”

Sources: Investing