Recent U.S. growth data have pointed to notable economic resilience — but consumer sentiment tells a more cautious story.

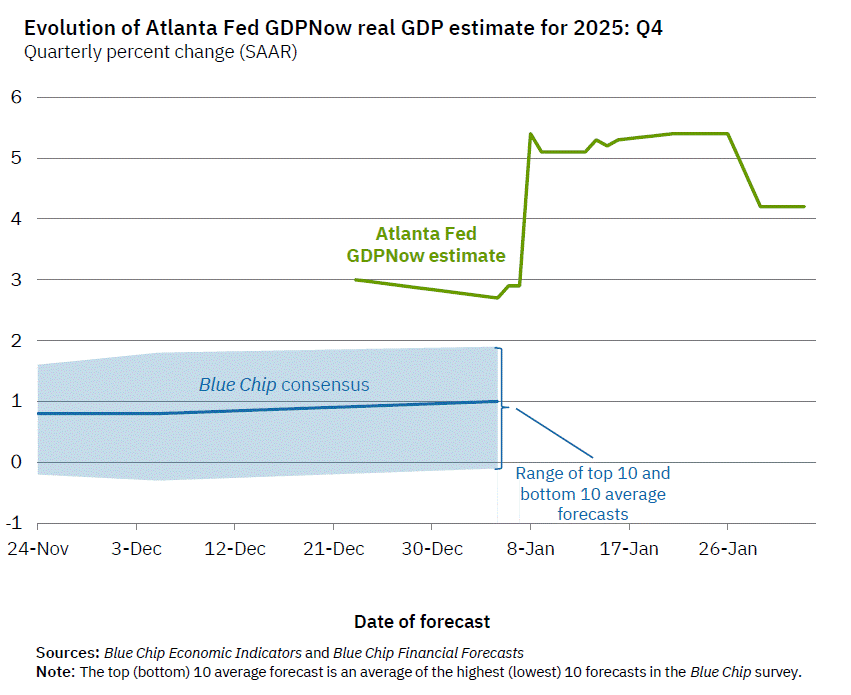

According to the Federal Reserve Bank of Atlanta, real Gross Domestic Product is projected to have expanded at an annualized pace of 4.2% in the fourth quarter of 2025. That figure exceeded expectations and represents one of the strongest quarterly performances in the past two years.

The expansion was supported by steady consumer spending, firmer exports, and higher government expenditures. Household consumption climbed 3.5%, its fastest rate of increase this year. On the surface, these numbers portray a macroeconomy that remains firmly in growth mode.

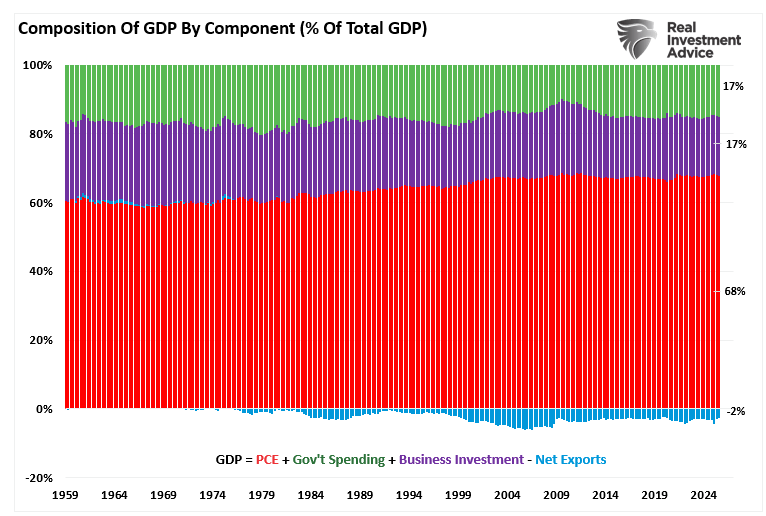

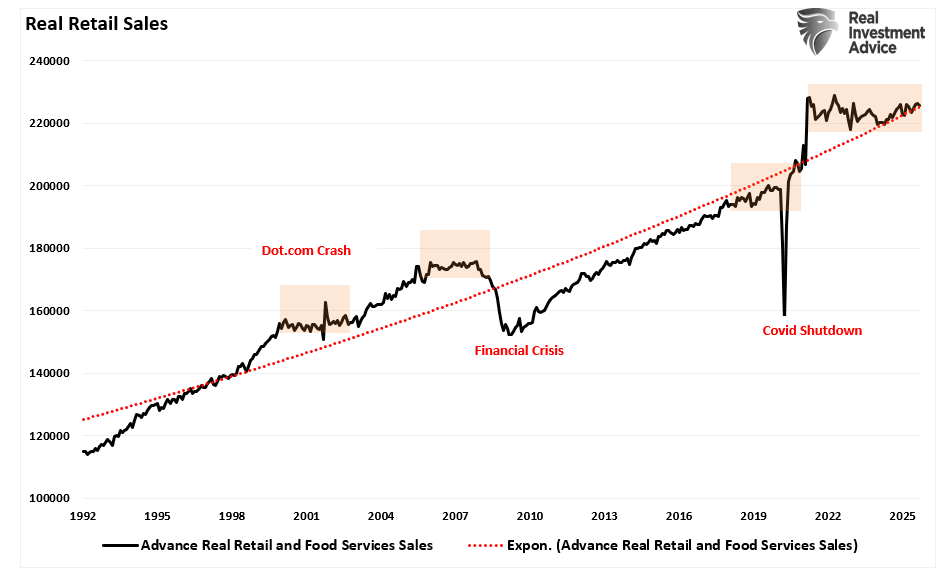

Gross Domestic Product (GDP) represents the total value of goods and services produced within the United States. Of that total, personal consumption expenditures (PCE) account for roughly 68%. Put simply, the consumer is the backbone of the U.S. economy — as household spending goes, so too goes overall economic growth.

When GDP rises, it reflects an increase in overall economic activity — stronger consumer demand that supports higher production and broader expansion. For that reason, growth rates are closely watched by policymakers, investors, and corporate leaders. Strong GDP figures are often interpreted as a signal of improving sales prospects and profit potential.

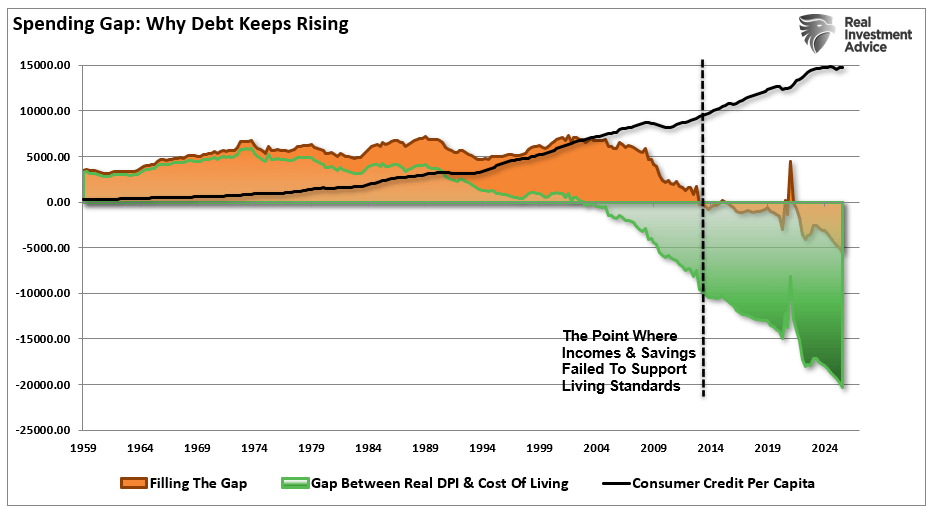

However, GDP does not tell the whole story of household financial well-being.

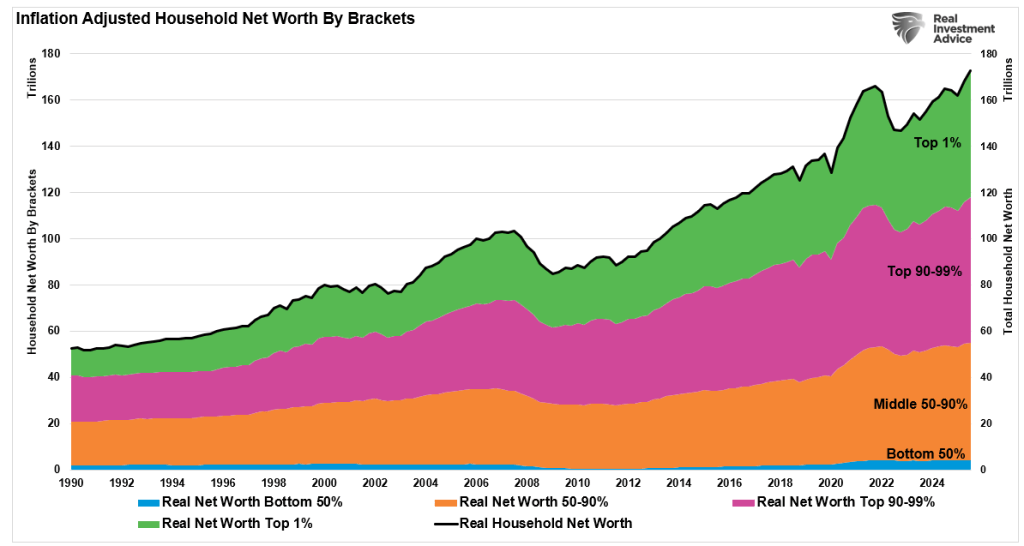

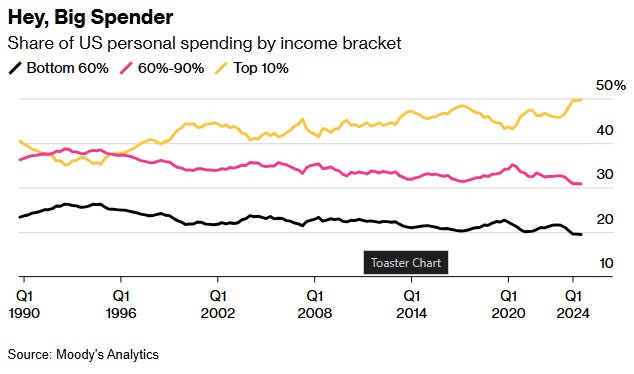

By design, economic growth data measure aggregate output. They do not reveal how income is distributed, how conditions vary across regions, or how millions of families actually experience the economy. A clear illustration is the breakdown of consumer spending by income level. At present, roughly half of all U.S. consumer spending is driven by the top 10% of earners — a share that has been increasing — while the spending contribution from the bottom 90% has been declining.

In other words, headline growth can appear solid even as the underlying breadth of participation narrows.

In short, strong headline growth can conceal areas of financial strain among households and small businesses. Expansion driven primarily by exports or government spending may not meaningfully filter through to broad segments of workers, creating a disconnect between aggregate output and lived experience.

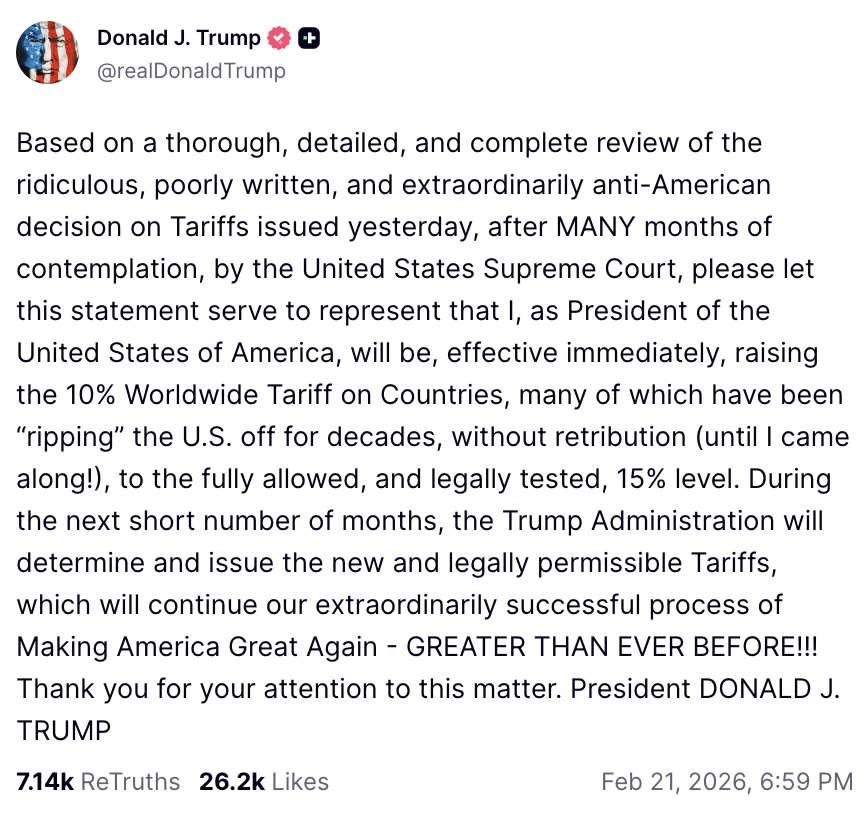

A clear example of this distortion appeared in 2025. In the first quarter, a surge in imports aimed at front-running tariffs weighed heavily on GDP. When those trade fears subsided in the second quarter, import flows normalized, producing a sharp rebound in growth. Yet these swings in trade data had limited direct impact on most consumers. The volatility was largely statistical rather than reflective of a dramatic shift in household conditions.

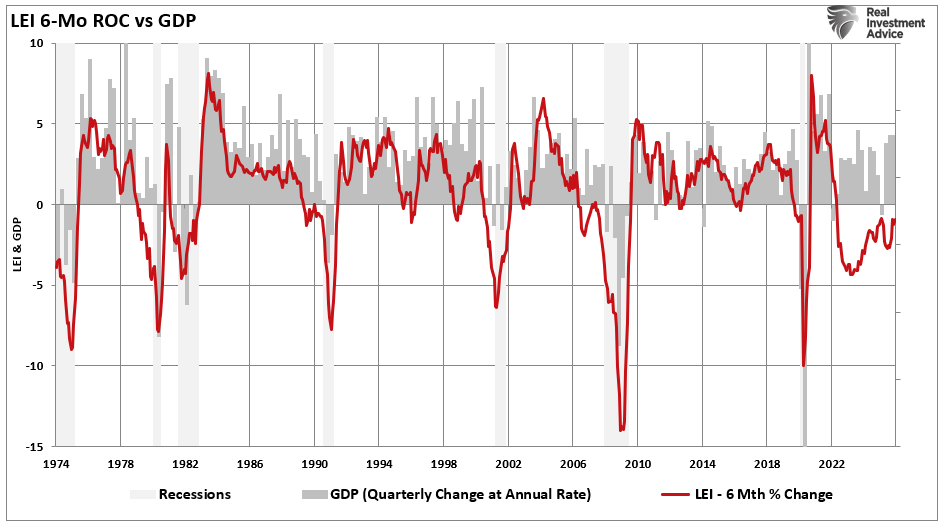

While GDP figures suggest a sturdy economic backdrop, other coincident and leading indicators tell a more cautious story. The The Conference Board Leading Economic Index (LEI), which historically leads the U.S. economy by roughly six months, has remained in contraction for an extended period. Its six-month rate of change has long been regarded as one of the more reliable signals of impending slowdowns or recessions.

Notably, however, despite the prolonged weakness in the LEI, the broader economy has not formally entered recession — underscoring the growing divergence between traditional warning signals and realized economic outcomes.

At first glance, headline growth data suggest the economy remains on firm footing. Output is expanding, spending is holding up, and aggregate indicators point to continued resilience.

But a closer examination reveals a more nuanced picture. Beneath the surface, several crosscurrents — from uneven income distribution and trade-related distortions to persistent weakness in leading indicators — point to a mixed underlying environment.

That divergence helps explain why economic sentiment can feel far weaker than the headline numbers imply. Strong aggregate growth does not automatically translate into broad-based confidence, particularly if gains are concentrated or forward-looking indicators continue to flash caution.

The Gap Between Rising Stocks and Weak Consumer Sentiment

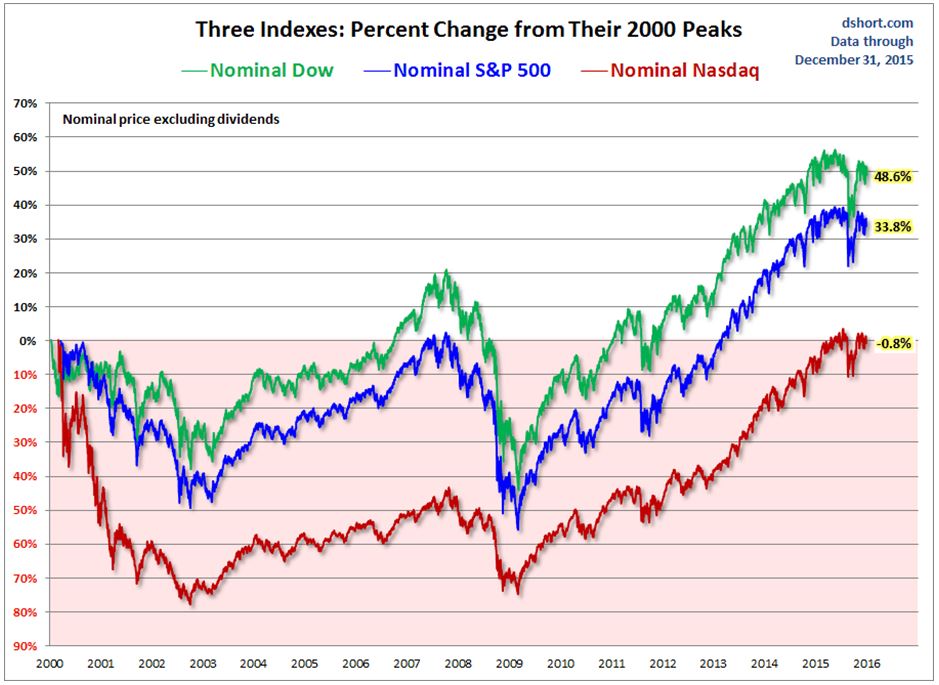

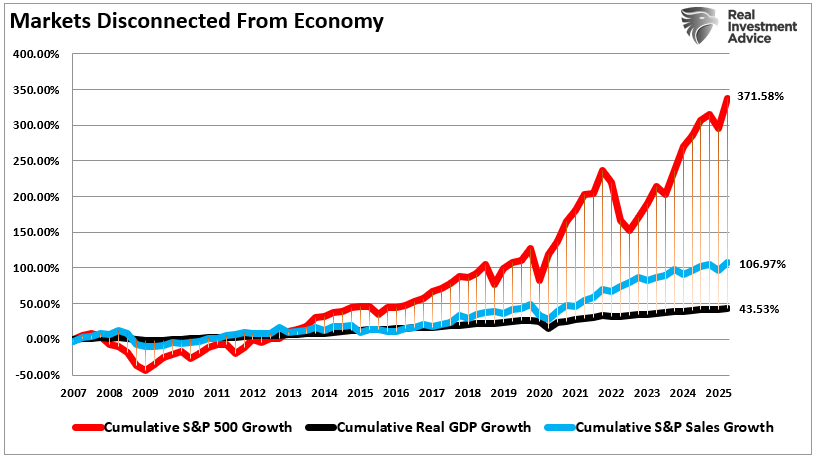

Historically, it makes sense that stock markets and economic data would trend in the same direction over the long run. Corporate earnings ultimately derive from economic activity, and sustained growth in output and income should support higher equity valuations over time.

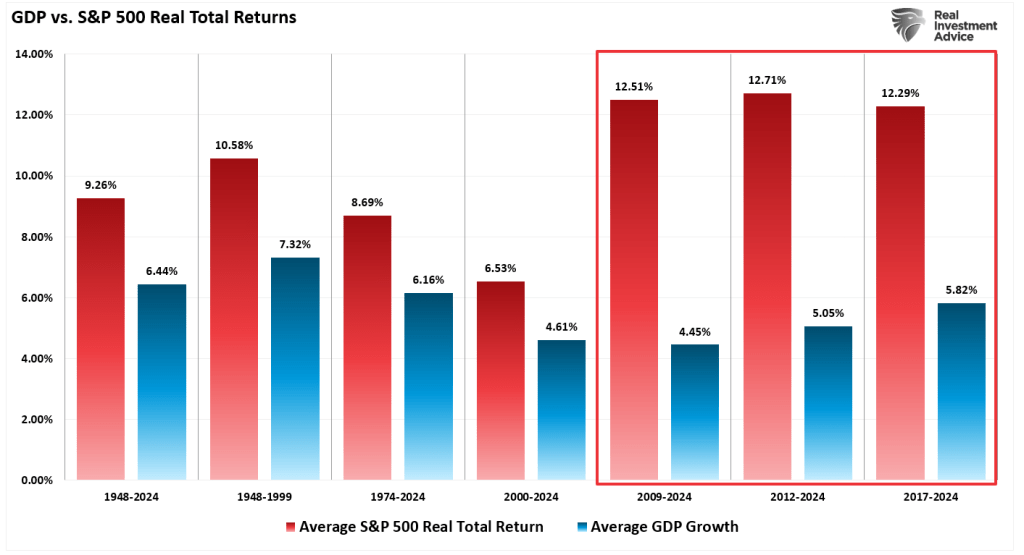

As discussed in “Return Expectations Are Too High,” long-term market returns are anchored to the growth of the underlying economy, productivity gains, and profit expansion — not simply short-term momentum or sentiment-driven rallies.

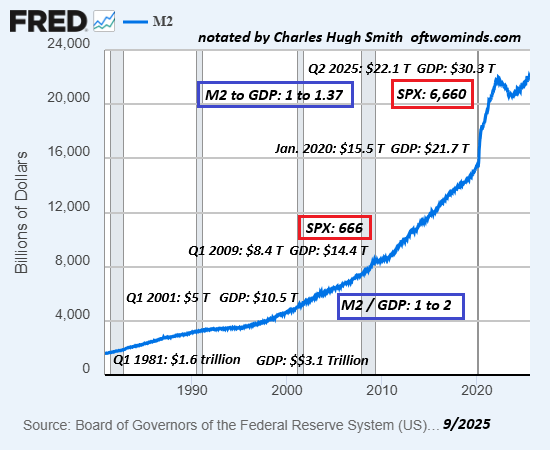

“The chart illustrates average annual inflation-adjusted total returns (including dividends) dating back to 1948, using total-return data compiled by Aswath Damodaran at the NYU Stern School of Business. From 1948 through 2024, the stock market delivered an average real return of 9.26%.

However, in the years following the 2008 financial crisis, inflation-adjusted total returns increased by nearly three percentage points across the last three measured periods.

Here’s the challenge: real (inflation-adjusted) equity returns are relatively straightforward to conceptualize. Over time, they reflect economic growth (GDP) plus dividend income, minus inflation. That relationship broadly held from 1948 to 2000.

Since 2008, though, the math has diverged. Nominal GDP growth has averaged roughly 5%, and dividend yields have hovered near 2%. Yet actual market returns have significantly exceeded what that underlying economic engine would normally justify in terms of sustainable earnings expansion.”

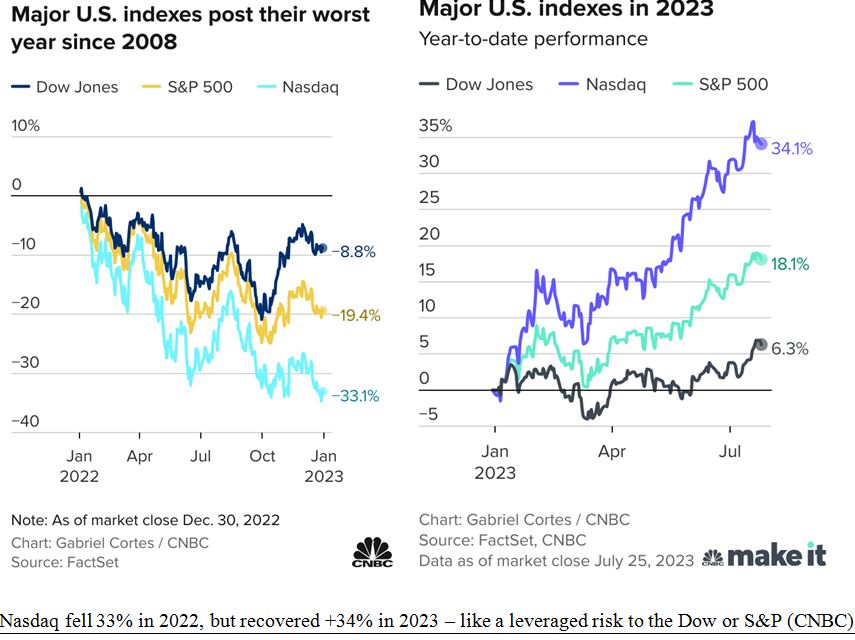

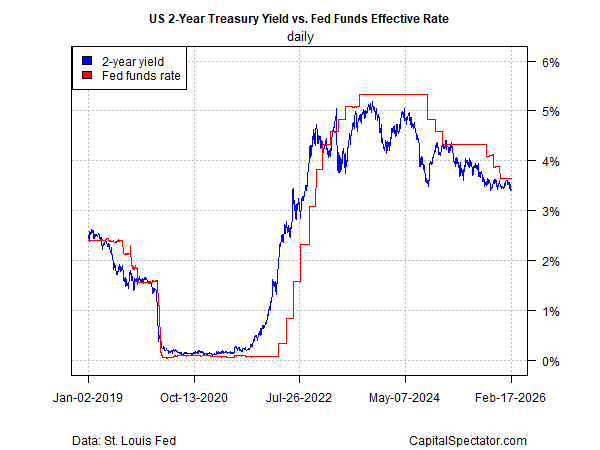

That 15-year divergence is not particularly surprising. As discussed in “Pavlov Rings the Bell,” markets have repeatedly been cushioned from deeper corrections by aggressive fiscal and monetary intervention.

Over the past decade and a half, major drawdowns were often met with policy stimulus — whether through deficit spending or actions by the Federal Reserve. Each episode of support was followed by market recovery, reinforcing a powerful feedback loop: intervention became associated with rising asset prices.

In effect, investors were conditioned to expect rescue during periods of stress — to buy every dip under the assumption that policymakers would step in. That conditioning ties directly to the concept of “moral hazard.”

Moral hazard (noun, economics): A reduced incentive to guard against risk when one is shielded from its consequences — as with insurance protection.

Following the Global Financial Crisis, near-zero interest rates and repeated rounds of quantitative easing strengthened the belief that a policy backstop would reappear whenever volatility increased. Over time, that expectation hardened into a reflexive behavior: assume support, assume recovery, assume higher prices.

Those sustained supports — in both the real economy and financial markets — helped drive a wedge between underlying economic fundamentals and realized financial returns. In other words, policy intervention became a key force behind the growing disconnect between economic reality and asset-price performance.

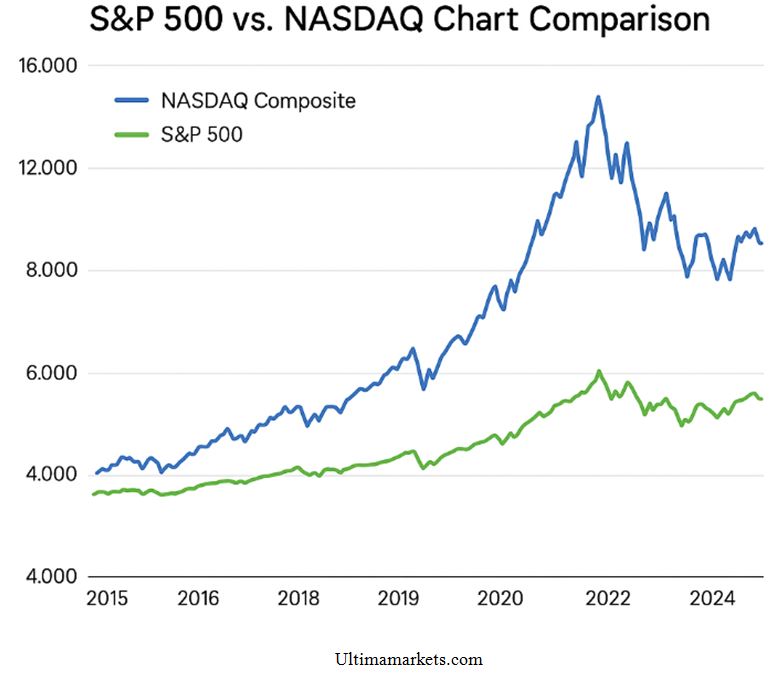

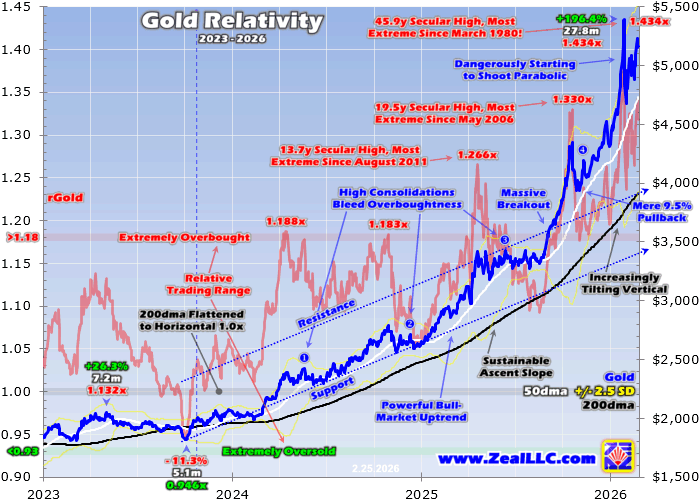

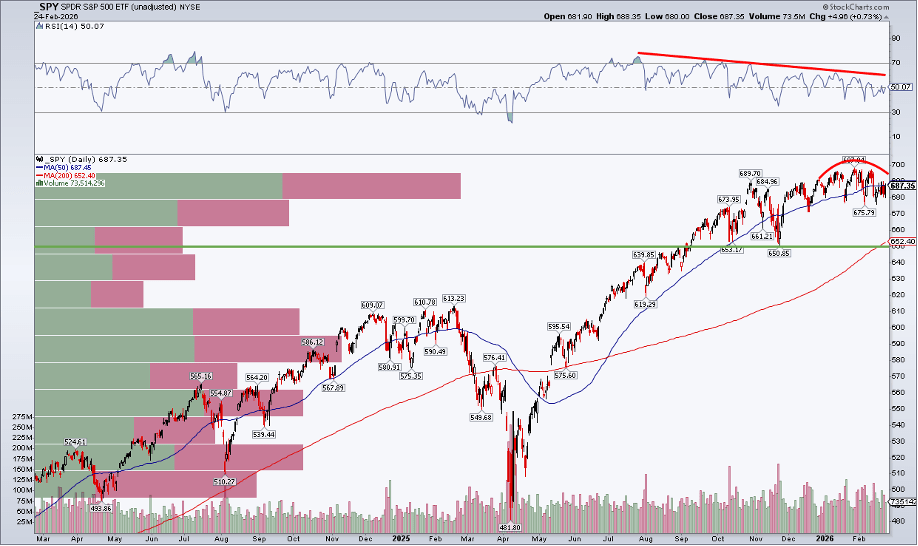

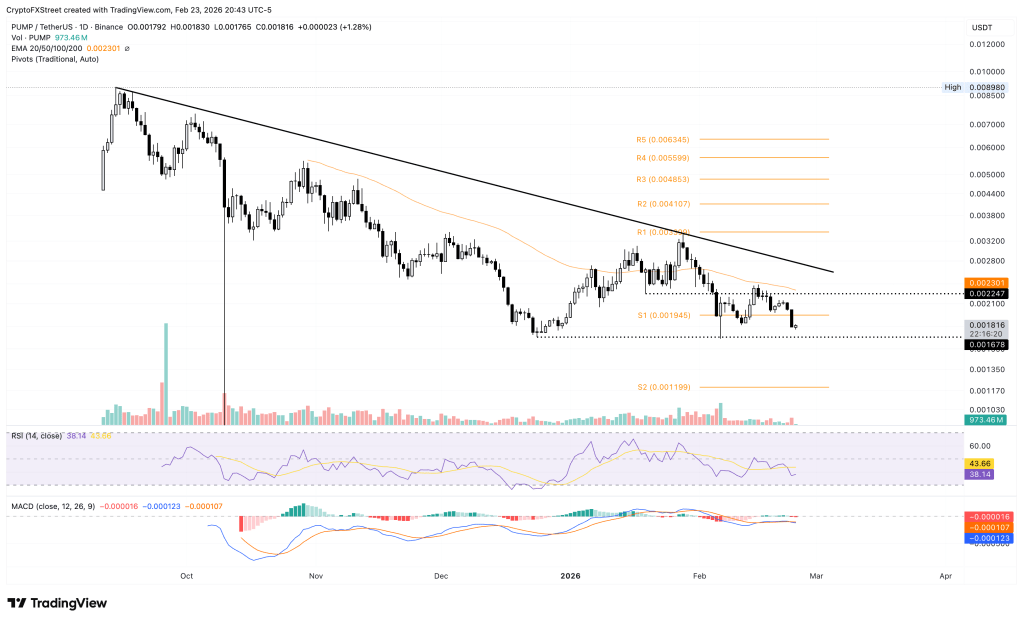

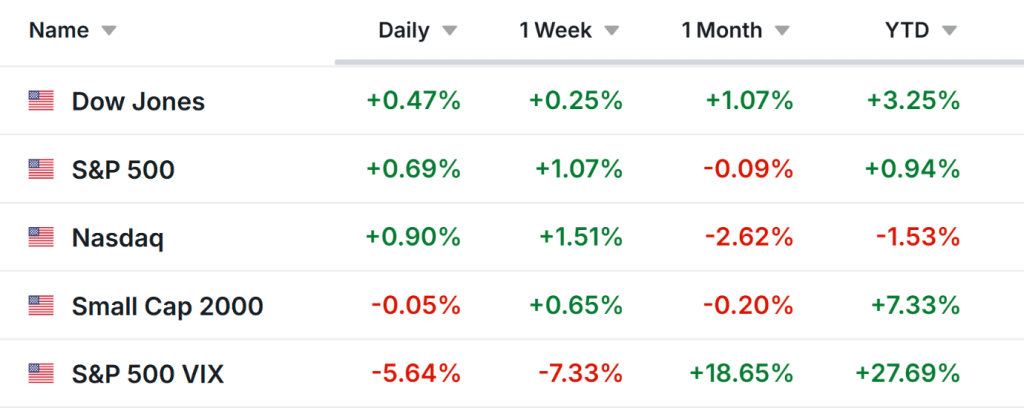

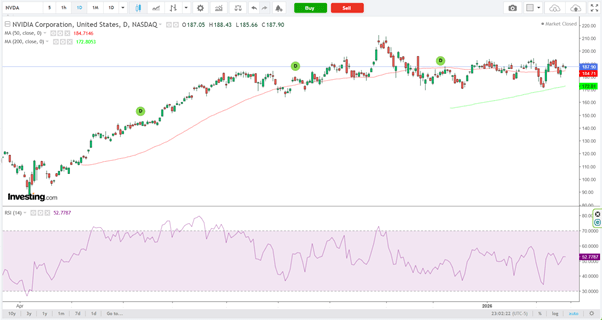

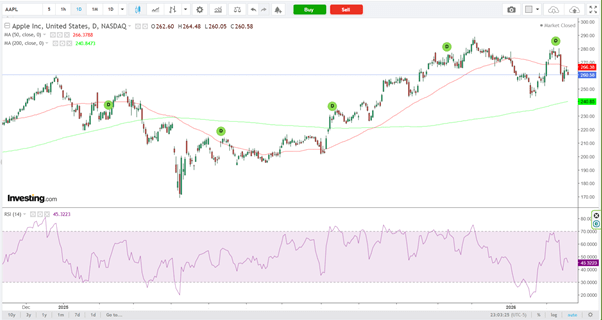

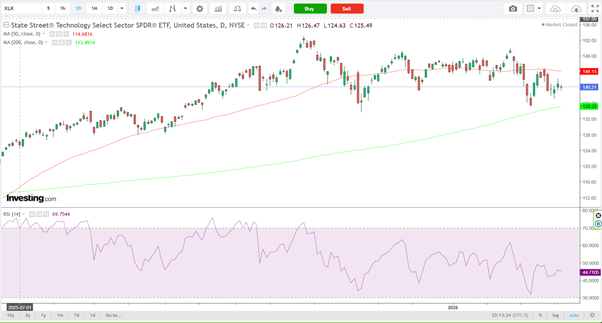

At present, GDP growth has continued to surprise to the upside, and several macro indicators reflect ongoing resilience. At the same time, major equity benchmarks such as the S&P 500 have climbed to record levels. That advance has been fueled less by current consumer sentiment and more by expectations of future earnings growth.

The challenge, however, is that equity valuations appear increasingly disconnected from underlying revenue growth. Markets are pricing in optimism about future expansion, even as broad-based income and demand trends remain uneven.

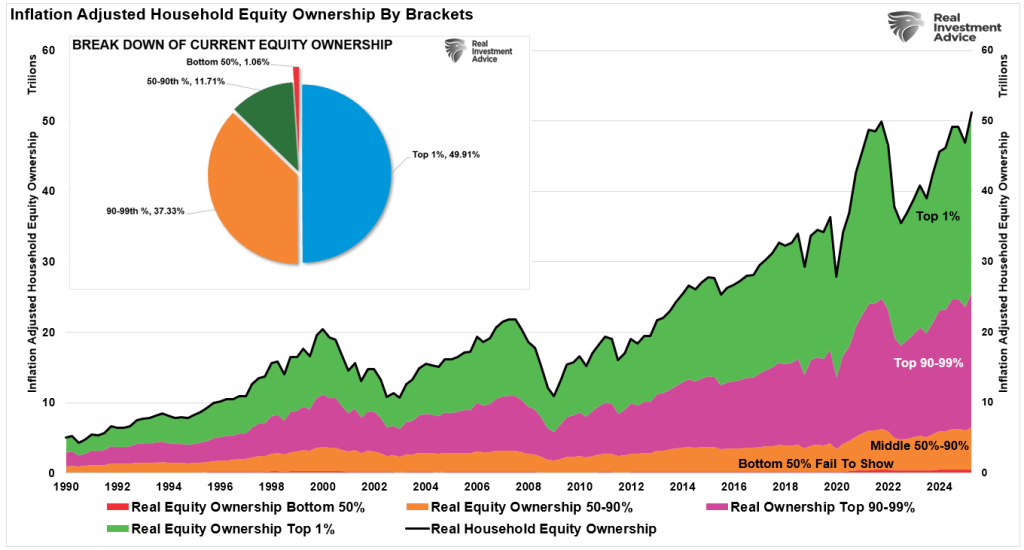

There is also a structural limitation embedded in the “wealth effect.” Rising stock prices can support consumption by boosting household net worth. Yet equity ownership in the United States is highly concentrated. Roughly 87% of equities are owned by the top 10% of households. As a result, the transmission from higher stock prices to broader economic activity is narrower than headline gains might suggest.

That concentration is reflected in spending patterns as well. The top 40% of income earners now account for approximately 80% of total consumption. Consequently, while financial asset values have surged, the macroeconomic lift from those gains is disproportionately tied to higher-income households — leaving sentiment among the broader population more subdued than market performance alone would imply.

That divergence goes a long way toward explaining the disconnect between subdued consumer sentiment and robust headline economic data.

When growth and market gains are concentrated among higher-income households — and asset-price appreciation primarily benefits those with significant equity exposure — aggregate statistics can remain strong even as large segments of the population feel financial strain.

In other words, the macro numbers reflect the strength of those driving the bulk of spending and asset ownership, while sentiment surveys capture the broader lived experience. The result is an economy that looks resilient on paper but feels far less secure to many households.

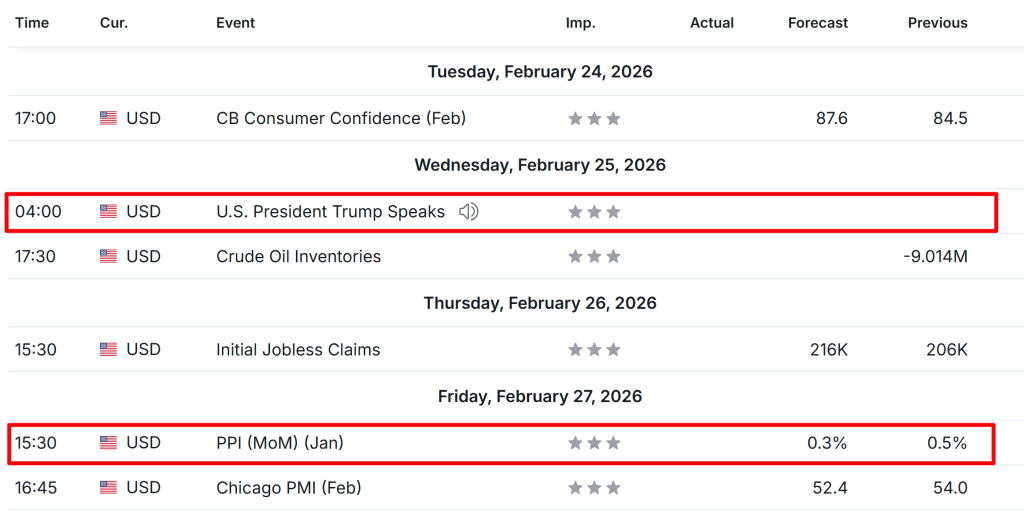

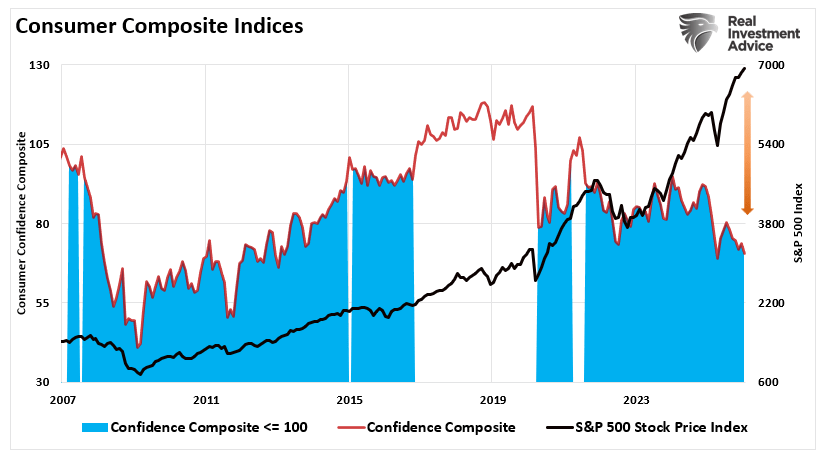

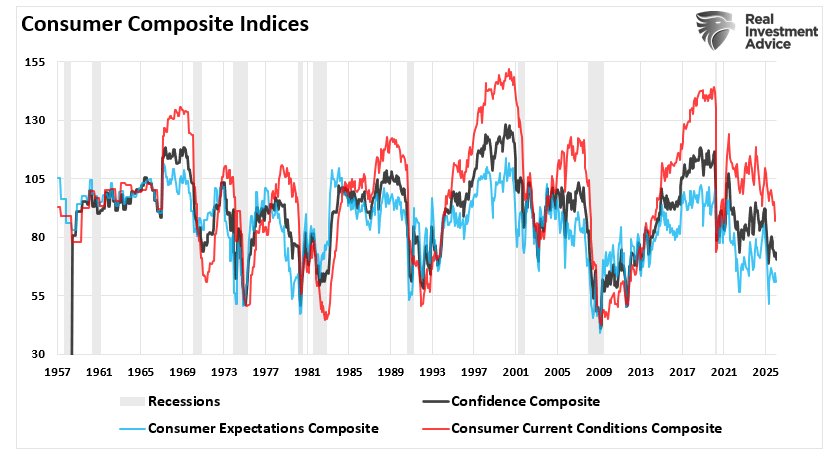

Consumer Confidence Surveys Remain Soft Even as Economic Data Stays Strong

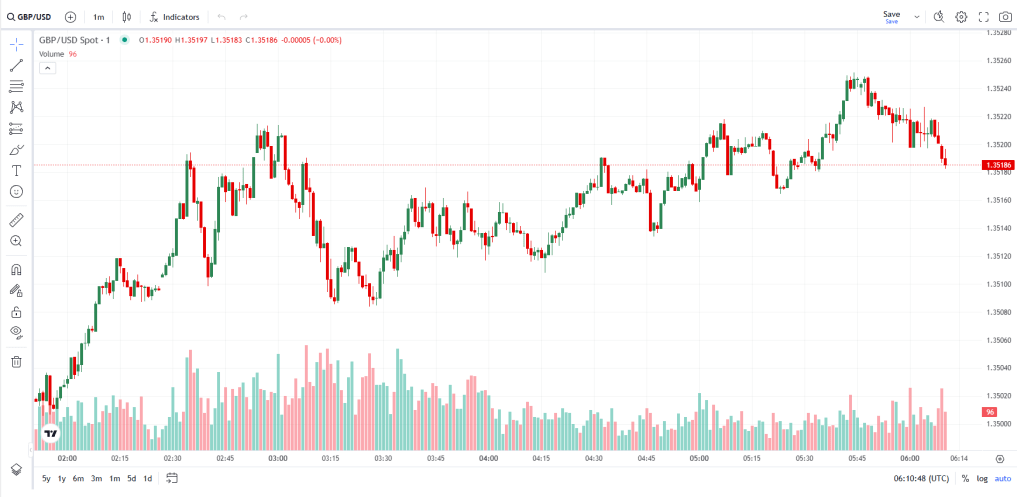

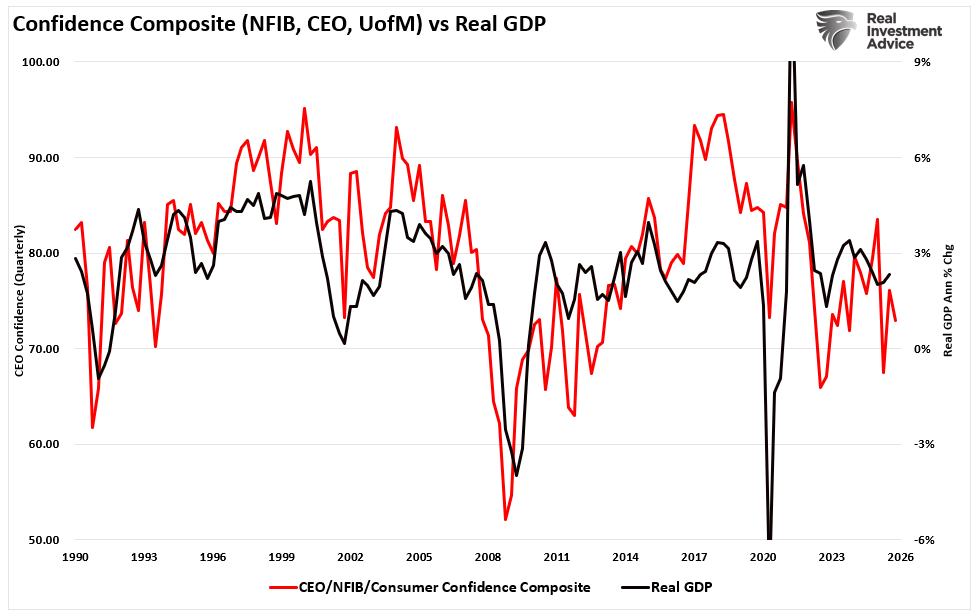

In clear contrast to upbeat macroeconomic indicators and strong equity market gains, consumer sentiment readings have deteriorated significantly. Both the Conference Board Consumer Confidence Index and the University of Michigan Surveys have fallen steeply over the past two years, even as stock prices have climbed. Historically, consumer sentiment tends to move in tandem with rising markets, which is intuitive. The chart below presents a composite measure combining these two leading sentiment indicators.

In both surveys, readings on current conditions and future outlook remain notably subdued, with the expectations component dropping to levels that have historically been linked to recession warnings.

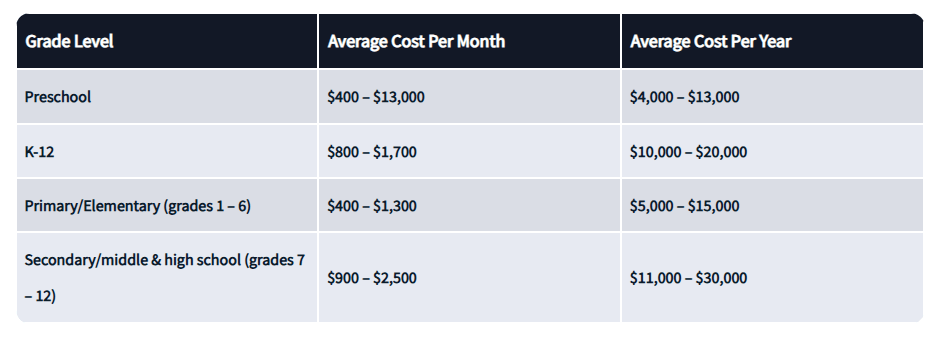

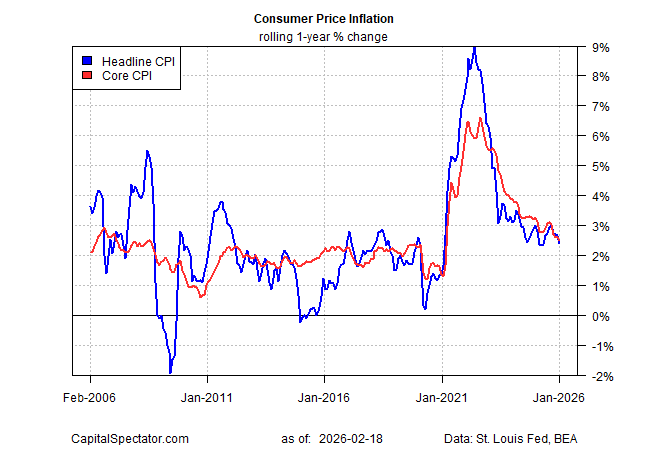

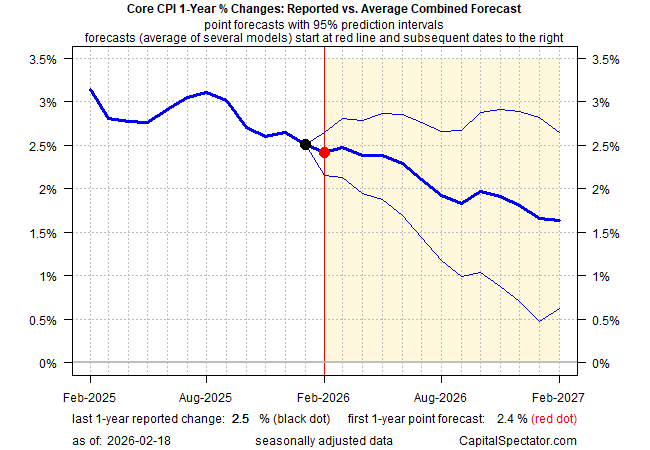

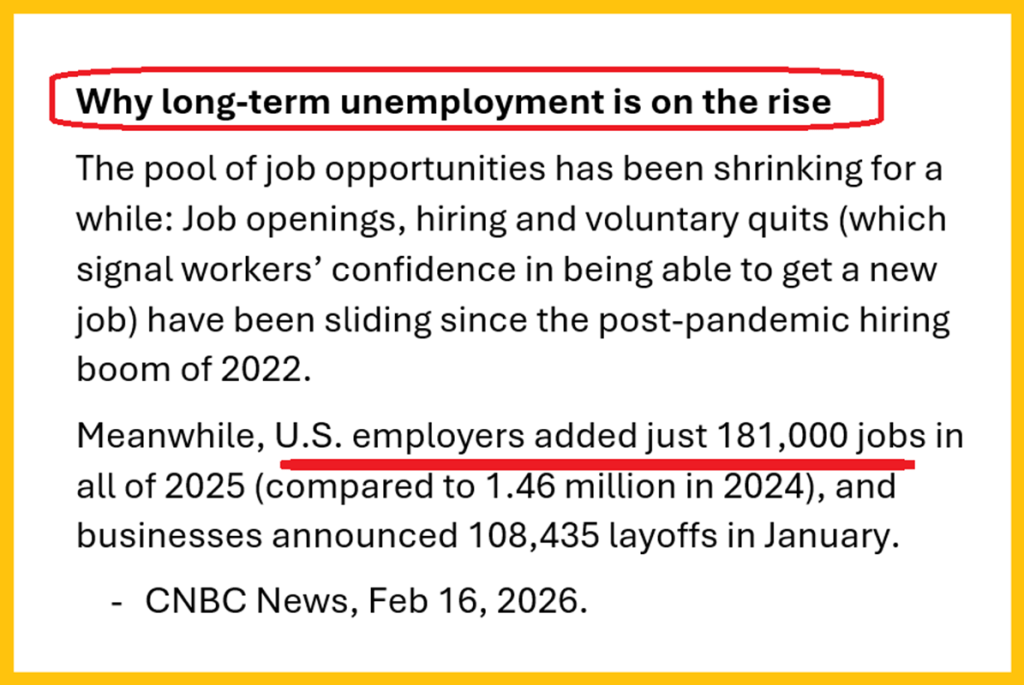

The downturn in sentiment points to rising concerns over employment prospects, business conditions, and future income. Respondents frequently highlighted worries about inflation, elevated prices, food and energy expenses, the affordability of health insurance, and broader geopolitical and political uncertainty. Yet despite this widespread unease, GDP has continued to grow.

Importantly, the gap between soft sentiment data and hard economic figures is not unprecedented. Analysts have often observed that consumer attitudes tend to lag underlying economic performance, and sentiment could improve if expansion persists. In the near term, surveys typically capture prevailing fears and uncertainty, which can weigh on confidence even when actual spending remains relatively solid. Although nominal figures indicate that consumer spending is holding up, much of that resilience reflects paying higher prices for the same—or even fewer—goods, rather than an increase in real consumption, which helps explain the sustained weakness in sentiment readings.

Importantly, if consumer sentiment influences spending—and consumption accounts for roughly 68% of the economy—then that spending ultimately represents demand for businesses of all sizes. In a genuinely strong growth environment, we would expect improving demand to be mirrored by rising confidence across households. Yet, as the composite index illustrates, sentiment levels remain subdued. The historical relationship between confidence measures and the future trajectory of economic activity underscores why this divergence warrants attention.

Soft sentiment readings do not necessarily signal an imminent downturn. However, they do reflect a guarded mindset among both consumers and business owners. That caution can translate into more restrained spending across key components of GDP. If confidence remains depressed, a moderation in economic activity would be a reasonable outcome.

Why the Divergence Matters and What It May Signal Ahead

The gap between solid economic data, rising equity markets, and subdued consumer confidence carries meaningful implications. On the surface, macro indicators point to continued expansion, reinforcing higher stock prices and optimistic earnings forecasts. Yet beneath that strength, households and many business owners report lingering insecurity and pessimism about the future.

This disconnect prompts several key questions:

- Can growth remain durable if confidence stays depressed?

- Will corporate earnings hold up if consumers begin to retrench?

- Could persistent pessimism eventually shape real-world behavior, leading to slower spending and softer growth?

History offers cautionary precedents where negative sentiment foreshadowed downturns—not because the hard data was inaccurate, but because sentiment ultimately influenced economic decisions.

The divergence also highlights distributional dynamics. Aggregate growth figures often mask disparities in income and wealth. Higher-income households account for roughly half of total consumption, while lower-income groups may not fully share in the benefits of expansion. That imbalance helps explain weaker sentiment readings. It also leaves markets vulnerable to any shock that prompts affluent consumers to scale back spending—particularly in an environment where the gap between economic “haves” and “have-nots” remains wide.

Investment Implications

For investors, this mixed backdrop argues for disciplined risk management. Markets may continue advancing on elevated earnings expectations, but those expectations can shift quickly as economic conditions evolve.

- Scrutinize valuations. Rising indices do not preclude overpricing. Favor firms with strong balance sheets, reliable cash flows, and pricing power.

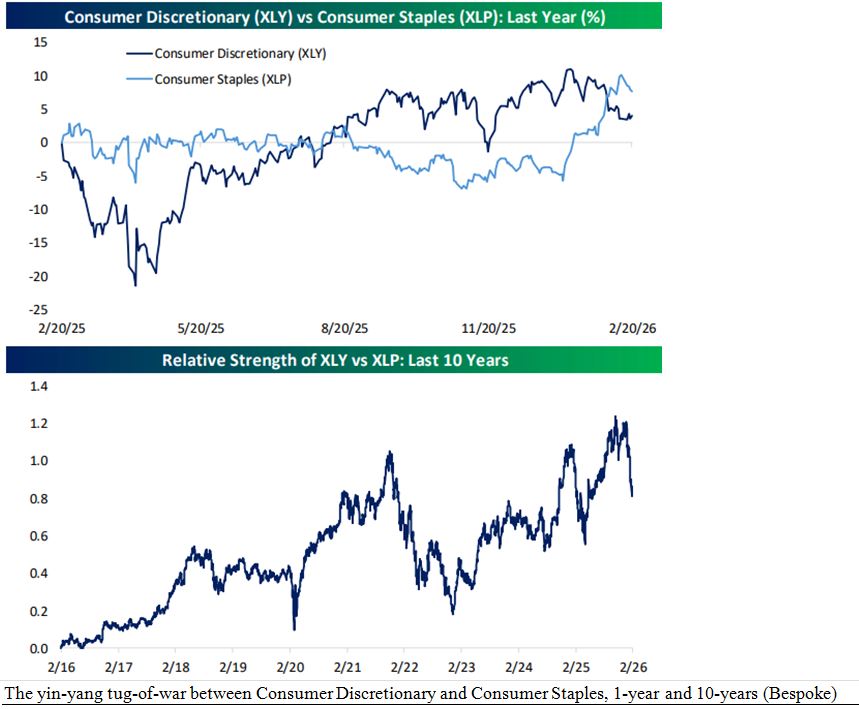

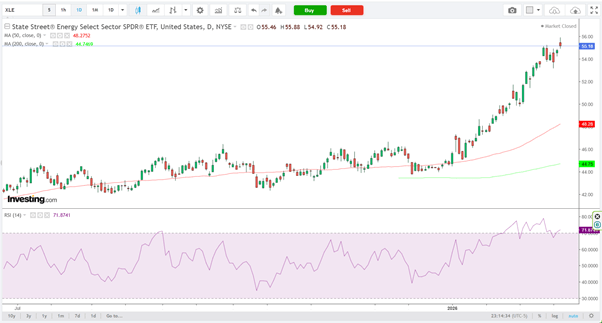

- Diversify thoughtfully. Sector performance can diverge sharply. Defensive areas such as utilities, consumer staples, and healthcare often prove more resilient during sentiment-driven slowdowns.

- Track leading indicators. Watch employment trends, consumer credit conditions, and forward-looking economic indices. Weak confidence can precede softer activity.

- Maintain liquidity. Holding cash provides flexibility amid volatility created by divergence.

- Consider hedging strategies. Exposure to bonds or volatility-linked instruments may help cushion downside risks.

- Emphasize quality. Companies with durable competitive advantages are typically better positioned to navigate uncertainty.

The split between hard data, market performance, and consumer mood represents a meaningful economic signal. While there are persuasive arguments that markets can continue climbing and that pullbacks should be bought, prudence requires acknowledging alternative outcomes.

To borrow a well-known observation from Bob Farrell:

Historically, when “all experts agree,” discipline and preparation for the unexpected have often proven wise.

Sources: Lance Roberts