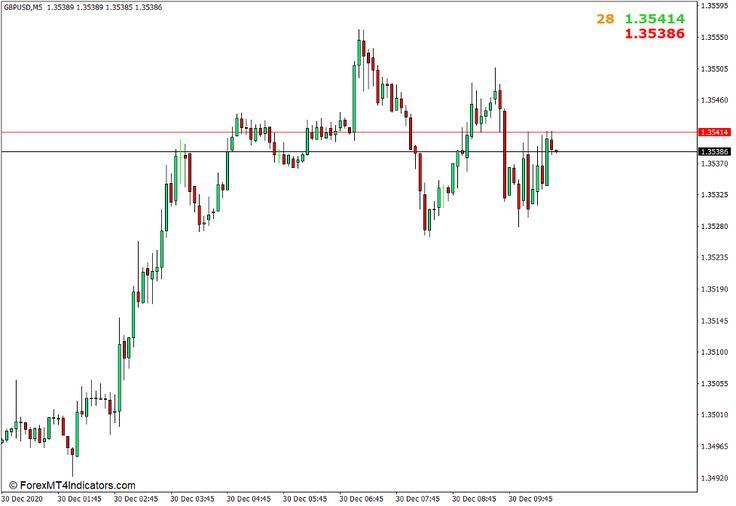

Bid and Ask

Bid price

- The Bid is the highest price buyers are willing to pay

- If you sell immediately, you sell at the bid

- Think of it as: “What the market will pay me right now”

Ask price (also called Offer)

- The Ask is the lowest price sellers are willing to accept

- If you buy immediately, you buy at the ask

- Think of it as: “What it costs to buy right now”

Example

If EUR/USD shows

- Bid: 1.1048

- Ask: 1.1050

This means

- You can sell EUR/USD at 1.1048

- You can buy EUR/USD at 1.1050

- The difference (0.0002) is the spread

Why bid is always lower than ask

- The gap between them is the spread

- The spread represents:

- Broker/market maker profit

- Liquidity conditions

- Transaction cost for traders

Key takeaway

- Buy → Ask

- Sell → Bid

- Spread = Ask − Bid